A comprehensive Loan Management System (LMS) designed to streamline and automate the entire loan lifecycle, from loan origination to closure. Financial institutions and lenders can now efficiently manage loans while ensuring compliance and reducing operational overhead.

Loan Management Software

Loan Management Software for SACCOs and MFIs in Africa

At Team Web, we provide a modern, cloud-based Loan Management System powered by ERPNext, designed to help SACCOs, microfinance institutions, cooperatives, and lending businesses across East and Southern Africa manage loans with ease, transparency, and full compliance.

Whether you’re operating in Nairobi, Dar es Salaam, Lusaka, or Johannesburg, our software enables you to handle loan applications, disbursements, repayments, interest calculations, collateral tracking, and statutory reporting, all in one integrated platform. With built-in support for local regulations, multi-currency, and automated repayment schedules, our system eliminates manual errors and gives you full control over your lending operations.

Loan Management Software Features

Loan Management

Create, track, and manage loans from application to disbursement, including custom loan types and repayment structures.

Loan Applications

Capture borrower details, assess eligibility, and process loan applications with built-in approval workflows.

Loan Disbursement

Disburse approved loans directly from your linked bank accounts or cash accounts, with proper accounting entries and documentation.

Repayment Schedules

Automatically generate flexible repayment schedules (weekly, monthly, custom) based on loan terms and interest rates.

Interest Calculation

Configure and apply flat or reducing balance interest rates with accurate daily, monthly, or annual compounding.

Payment Tracking

Track all repayments, outstanding balances, penalties, and overdue accounts in real-time with auto-ledger posting.

Penalty Management

Set and apply penalties for late payments based on your lending policy, with automated calculation and alerts.

Member & Customer Integration

Link loans to ERPNext customers or members (ideal for SACCOs and MFIs), and access full financial and interaction history.

Loan Collateral Management

Record and manage collateral or guarantor details to support secured lending, including asset documentation and valuations.

Approval Workflows

Implement multi-level approval hierarchies for different loan sizes or types, enhancing risk control and transparency.

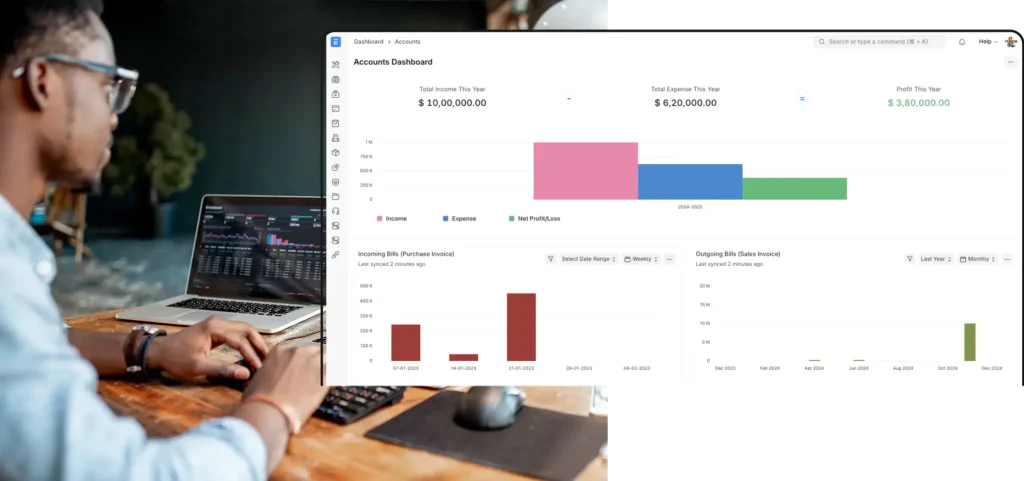

Statements & Reports

Generate borrower loan statements, aging reports, and interest income summaries for internal use or external audits.

Our Happy Clients

Our Implementation Process

Why Choose Us

We are trusted leaders in ERPNext implementation, custom business software solutions, and digital transformation services across Kenya, Tanzania, Uganda, Zambia, and South Africa. What sets us apart is our deep industry expertise, hands-on local support, and a proven track record of success across sectors including construction, oil and gas, manufacturing, education, retail, agrovet supply chains, and financial services. We don’t just deploy software—we work closely with your team to align technology with your business goals. Our solutions are designed to cut operational costs, streamline inventory management, automate payroll, and boost team productivity. With a local presence and global standards, we are your go-to partner for end-to-end ERP systems in East Africa.

ERPNext Installation & Setup – Get Started Fast

We offer quick and reliable ERPNext setup on cloud or on-premise servers. Our team configures the ERPNext environment with the right modules – from Accounting and HRMS to Manufacturing and CRM – tailored to your industry, whether it’s construction, distribution, agriculture, retail, or finance. We also provide cloud hosting for ERPNext in Kenya and across Africa for enhanced speed, security, and scalability.